Your childhood experiences with money are affecting your business.

Think about it…..what is your earliest memory of money from childhood?

What lesson did you learn from it?

Who taught it to you?

How do these lessons, for good or bad, show up in your business today?

I asked these questions to every small business owner I interviewed for my book, Dancing with Numbers, and their responses were so insightful to me, but even more importantly, very revealing for them.

Interested to learn more about the correlations between business owner’s relationship to their money and childhood experiences, a financial therapist (YES!….financial therapists do exist) gave me this advice.

Rick Kahler is one of the people that coined the term “Money Scripts.” According to Kahler Financial Group, Money scripts are beliefs we have acquired about money and how it works.

“We are usually unaware of these beliefs, in part because we see them as facts—’just the way it is.’ We typically hold 50 to 200 money scripts, which affect every financial decision we make.”

The four main categories are:

1) Money Avoidance – Believe money is bad, they don’t deserve it, and that wealthy people are greedy and corrupt

2) Money Worship – Believe money is the key to happiness and the solution to every problem. Never satisfied in their pursuit of money.

3) Money Status – Link their self-worth with net worth. May be at risk of overspending due to prioritizing outward displays of wealth.

4) Money Vigilance – Alert and watchful of their finances. Feeling they have enough money is highly important. They are savers and bargain shoppers.

Once I shared these scripts with the people I interviewed, I asked them to figure out which one they identified with.

Just by having the discussion and answering the questions during the interview, the small business CEOs were awakened to what is driving some of their destructive beliefs, behaviors and thought processes around money.

They also realized how their money scripts are affecting the profitability of their business.

Have you ever done this exercise? You might be surprised with what you come up with.

I encourage you to have an honest conversation with yourself. Answer the questions. Determine which money script category you fall into.

Gain awareness of your feelings and beliefs around money, and their source.

If they are not helpful or additive to your business, it is your responsibility to do something about it

One of the resources available to support small business owners who want to have a different relationship with money, is the Financial Therapy Association. It was started by certified financial planners and therapists who focus on helping people shift their money mindset.

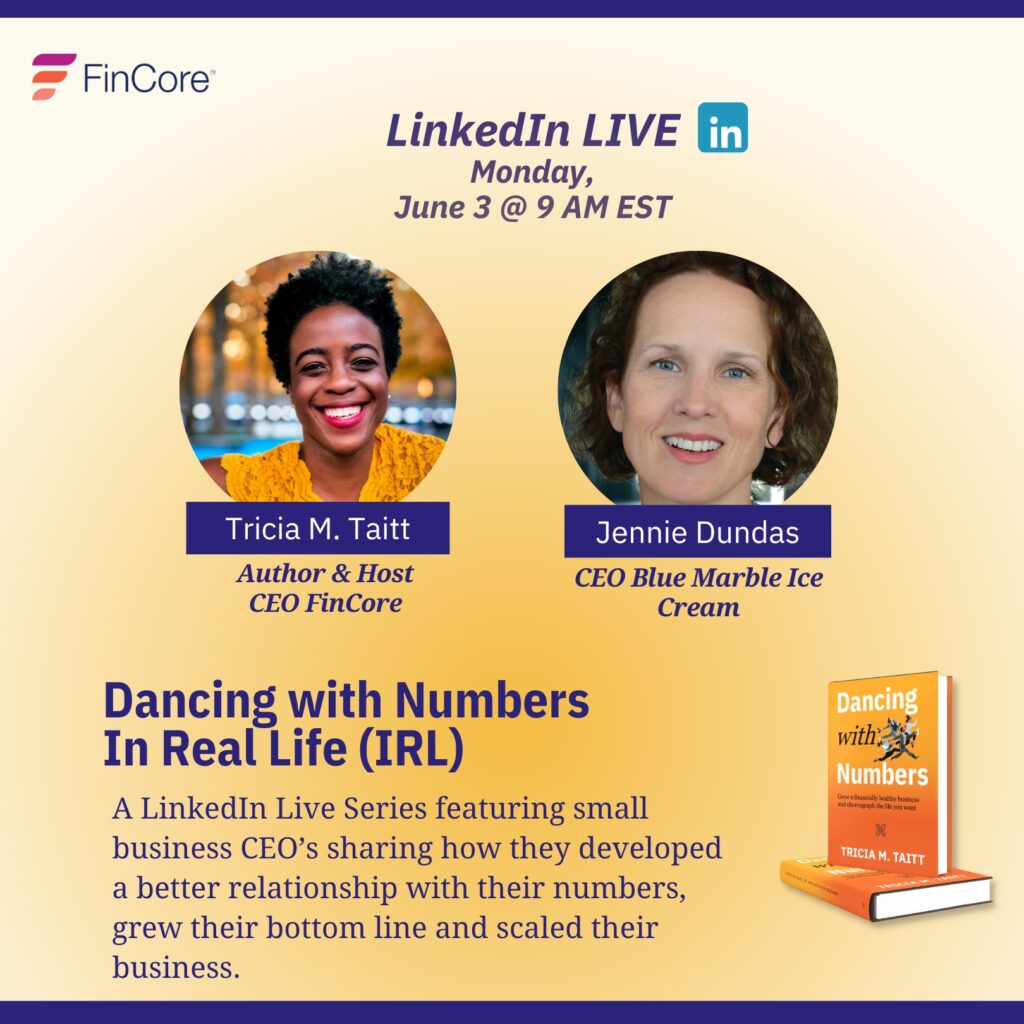

I will also be having conversations like this on my upcoming

Linked In Live Series: “Dancing with Numbers IRL.”

Stay tuned for the first one, coming Monday, June 3 at 9 AM EST, with our guest Jennie Dundas, CEO of Blue Marble Ice Cream.

Here’s three steps to be sure you don’t miss it:

1. Mark your calendar for June 3

2. Make sure you are following me on Linkedin

3. Hit the notification bell on my Linkedin profile

And if you’re an overachiever like me, go to Audible, download my book and listen to Chapter 6 featuring Jennie, “Move From Your Core.”

-Tricia

Tricia Taitt is the CEO and Chief Financial Choreographer of FinCore. She holds an M.B.A from The Fuqua School of Business of Duke University, and a BS in Economics with a Finance concentration from The Wharton School at the University of Pennsylvania. For over 20 years, she’s been a finance professional. Half of the time was spent working on Wall Street while the other half was spent in the trenches side by side with small business owners. As a result of working with FinCore, clients have been able to take control of their numbers and feel more confident in their ability to make decisions, while increasing profits by 10% and building a cash stash to invest in growth. Follow Tricia on LinkedIn and Instagram.

If you’re ready to see what our team of CFOs can do for your small business, Book a Financial Consult.