If you want someone to run the financial aspects of the business and also work side by side with your bookkeeper and your CPA so you can focus on closing sales and bringing in revenue…

If you want help fixing the problems in your financial operations so you can increase profitability and move in the direction of financial health and well-being…

If you want someone to provide you the right financial information at your fingertips so you can confidently make decisions…

And, if you want to breathe easier knowing you have an advocate and financial dance partner with deep knowledge of your business on your leadership team…

….then work with a FinCore financial choreographer that doesn’t just feed you strategy and complicated reports but instead, implements recommendations and educates you about the numbers along the way. While our approach is fun, engaging, and relatable, we give a bit of tough love to get you and your business to peak performance.

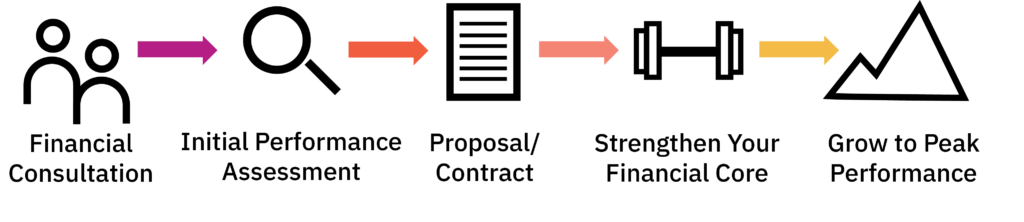

Our Process

5 Levels of Service

What People Are Saying

“Not only is Tricia extremely knowledgeable on the financial management necessary to run a business at all stages of development, she is a highly engaging speaker. Her presentation had a huge impact on participants of my business startup class, and I could see the influence of the content and advice she shared with us in their final business plans. I cannot recommend Tricia highly enough as a presenter and speaker.”

“I engaged with Tricia because I needed major help gaining a picture of my business’ financial position, organizing my financials with accounting, and ensuring the current and future health of your business through cash flow management. Because of Tricia, I finally understand what is going on with my financials — which is very empowering — and can start managing my business smarter.”

“When Tricia arrived, our already fast-paced company was having a record-breaking year. She was able to understand the business and be effective. She was able to understand the business and be effective very quickly. Tricia took a “hands-on” approach to the work that needed to be done to bring our finance department back to working order. She kept the finance department running smoothly so the rest of the leadership team could focus on their teams.”

“Previous to FinCore coming aboard, the job of managing Wethos’ finances was inefficiently shared across our three co-founders. Bringing FinCore on allowed us to re-focus on our strengths, leaning on her expertise to get us setup for success. She helped organize insights from well before her time working with us, so we’d be able to easily answer financial questions and prepare reports on an on-going basis moving forward. Tricia always comes to the table with good recommendations paired with even clearer reasons why the work will be beneficial.”

“Tricia and FinCore served as interim CFO for our business at a time when our financial operations were in transition. We had hired a new bookkeeping firm, moved onto a new PEO/payroll system, and hired a new VP of HR. Tricia and her company oversaw all accounting and financial matters and, in 9 months: cleaned up our financial records, put controls and process in place to streamline payroll for 400+ employees, worked collaboratively with our staff and vendors to maintain the integrity of our financial department, and partnered with our CPA to resolve several outstanding external issues. This placed us in a stable position to hire a full time CFO. Tricia was instrumental in on-boarding that person as well.”